Vancouver, B.C., May 30, 2024 – Forum Energy Metals Corp. (TSX.V: FMC; OTCQB: FDCFF) (“Forum” or the “Company”) announces that it has entered into an option agreement (the “Option Agreement”) with Global Uranium Corp. (“Global”) wherein it has granted Global the right to acquire up to 75% of the Company’s interest (the “Company’s Interest”) in a joint venture (the “Forum NexGen JV”) between the Company and NexGen Energy Ltd. (“NexGen”) formed by way of a joint venture agreement between the Company and NexGen (the “Forum NexGen JV Agreement”).

The Forum NexGen JV was formed for the sole purpose of carrying out the obligations and enjoying the rights of the Company under a joint venture (the “Northwest Athabasca Joint Venture”) formed between the Company, Cameco Corporation and Orano Canada Inc. to explore and develop certain mineral claims in the Northwest Athabasca region of Saskatchewan (the “NWA Project”).

The Company currently holds a 62.2% beneficial interest in the Forum NexGen JV, which in turns holds a 69.95% beneficial interest in the Northwest Athabasca Joint Venture. Accordingly, the Company holds a 43.32% beneficial interest in the Northwest Athabasca Joint Venture. These percentage interests are subject to adjustment from time to time in accordance with the terms of the Forum NexGen JV and the Northwest Athabasca Joint Venture, as applicable.

Global has an initial right (the “Initial Option”) to acquire 51% of the Company’s Interest by:

- making staged payments to the Company totalling $225,000 by December 31, 2027;

- making staged issuances to the Company of a total of 1,000,000 shares of Global by December 31, 2027; and

- making staged payments to the Company equal to the amounts the Company would be entitled to contribute for exploration under the Northwest Athabasca Joint Venture on account of the 2025-2028 operating years totalling a minimum of $3,900,000 and up to a maximum of $9,000,000 to be applied to the corresponding cash calls, depending on the participation of the minority partners in the Northwest Athabasca Joint Venture in any approved exploration program.

Forum will remain Operator of the Northwest Athabasca Joint Venture during the Initial Option period.

Upon exercise of the Initial Option, Global shall become a party to the Forum Nex/Gen JV Agreement and shall agree to be bound by all of the terms and conditions thereof. Global shall also have the right (the “Second Option”) to acquire a further 24% interest in the Company’s Interest (for a total of 75%) by making payments to the Company equal to the amounts the Company would be entitled to contribute on account of the 2029-2031 operating years totalling a minimum of $4,750,000 and up to a maximum of $11,000,000, depending on the participation of the minority partners in the Northwest Athabasca Joint Venture in any approved exploration program.

In circumstances where Global has exercised the Initial Option it shall assume the obligations to make certain milestone payments to the Company. In this regard, if there is a preliminary economic assessment prepared with respect to the Project or any part thereof, Global shall pay the Company $1,000,000. Further, if there is a feasibility study prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects, with respect to the Project or any part thereof Global shall pay the Company a further $1,000,000 and shall issue to the Company 1,000,000 common shares of Global.

In circumstances where the Option Agreement is terminated in accordance with certain provisions thereof, the amount remaining due on account of the 2025 operating year, to a maximum of $3,000,000, shall be a mandatory payment due and payable to the Company.

The Option Agreement is subject to acceptance of the TSX Venture Exchange and all securities issued will be subject to a four month hold period in accordance with applicable securities laws.

Northwest Athabasca Joint Venture Project

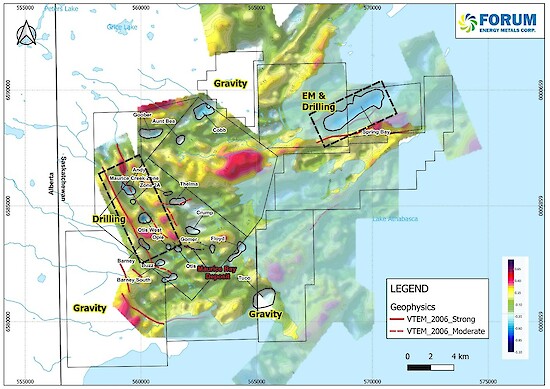

The NWA Project lies on the northwest shore of Lake Athabasca, approximately 70 km west of Uranium City and immediately east of the Alberta border. The NWA Project lies along the edge of the Athabasca sandstone basin, with sandstone cover ranging from 0 to 200 m thick; with approximately half of the NWA Project lying just outside the basin, which allows exploration for basement-hosted, unconformity-related uranium targets. The NWA Project consists of 11 claims for 13,845 ha.

The multiple showings and occurrences of uranium mineralization on the NWA Project suggests the project area is fertile for uranium mineralization. These include the Maurice Bay deposit with a historical estimate* of 1.5 million lb U3O8 at 0.6%, the Zone 2A basement-hosted showing with an intercept of 5.68% U3O8 over 8.5 m, and several occurrences within basement rocks identified from previous drilling (e.g. Opie, Barney and Otis West – see Figure 1).

A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves and Forum is not treating the historical estimate as current mineral resources or mineral reserves.

The 2025 exploration plans at the NWA Project will concentrate along the main conductor trend targeting cross-cutting faults and gravity lows, as well as the largest gravity low on the Project located at Spring Bay. A radioactive boulder field without an identified source lies down-ice along the north shore of Spring Point. A drill hole by Cameco Corp. in 2008 (NWA-01) just to the west of the gravity low identified weak mineralization (520 ppm U) and alteration and recommended further drilling in this area.

The initial program will also complete gravity coverage on any unsurveyed areas on the NWA Project (see Figure 1) and a ground EM survey will cover the Spring Bay target area. Additional geophysical surveys may be proposed as the project evolves. This will be followed by a diamond drill program of 3,000 to 4,500 metres with a budget of $3,000,000.

*Source: A 1.5 million pound historical uranium resource grading 0.6% U3O8 (600 tonnes U grading 0.5% U) for the Maurice Bay deposit, as reported by Uranerz Exploration & Mining by Lehnert-Thiel, K., Kretschmar, W., and Petura, J. (1979): The geology of the Maurice Bay deposit; CIM Dist. 4, 4th Annual meeting, Winnipeg (ext. abstr.) has not been calculated or classified under the specifications of National Instrument 43-101 and should not be relied upon.

Rebecca Hunter, Ph.D., P.Geo., Forum’s Vice President of Exploration and Qualified Person under National Instrument 43-101, has reviewed and approved the contents of this news release.

Figure 1 Residual Gravity Map of the NWA Project with Proposed 2025 Exploration Plans. The background shows the residual contoured gravity data overlain with the main target areas. Blues are gravity lows and reds gravity highs. Additional gravity surveys will be completed as outlined above and 2025 drilling will concentrate on the Andy/Opie trend and Spring Bay area. Bouguer density 2.50cm/cc; Terrain Corrections: r=750m by DEM.

About Forum Energy Metals

Forum Energy Metals Corp. (TSX.V: FMC; OTCQB: FDCFF) is focused on the discovery of high-grade unconformity-related uranium deposits in the Athabasca Basin, Saskatchewan and the Thelon Basin, Nunavut. For further information: https://www.forumenergymetals.com.

This press release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause Forum’s actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include but are not limited to: uncertainties related to the historical data, the work expenditure commitments; the ability to raise sufficient capital to fund future exploration or development programs; changes in economic conditions or financial markets; changes commodity prices, litigation, legislative, environmental and other judicial, regulatory, political and competitive developments; technological or operational difficulties or an inability to obtain permits required in connection with maintaining or advancing its exploration projects.

ON BEHALF OF THE BOARD OF DIRECTORS

Richard J. Mazur, P.Geo.

President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact:

Rick Mazur, P.Geo., President & CEO

mazur@forumenergymetals.com

Tel: 604-630-1585